Effective Tax Rate

The Effective Tax Rate (ETR) measures the percentage of a company’s pre-tax profits that is paid as tax. Unlike statutory tax rates, which are legally prescribed by a jurisdiction, the ETR provides a more accurate picture of a company’s actual tax burdenTax liability represents the total amount of tax owed by an individual or business to a tax authority, whether local, national, or international. This obligation arises through various forms of income, profits, or transactions subject to taxation laws and regulations. Understanding tax liability is essential for compliance and efficient financial management for corporations and individuals. It influences how businesses structure... More by incorporating various deductions, credits, and exemptions available. It is a crucial metric for assessing a company’s tax efficiency, financial health, and its approach to tax planningTax planning is the process of organising and structuring one’s financial affairs in a manner that legally minimises tax liabilities while ensuring compliance with relevant tax laws. The primary objective of tax planning is to reduce the amount of taxes paid, optimise the use of available tax benefits, and preserve wealth. It can be applied at various levels, including personal... More and risk management. Tax professionals, students, and revenue authorities often use ETR to compare tax obligations across different companies, industries, and countries.

Understanding the Effective Tax Rate

The ETR is calculated by dividing a company’s total tax expenses by its pre-tax earnings and then multiplying by 100 to get a percentage. This simple formula encapsulates a complex reality, as companies often operate in multiple jurisdictions, making it possible for the ETR to differ significantly from the statutory rate.

This discrepancy arises from the various deductions, exemptions, and credits companies may apply to their income, as well as from the effect of tax treaties and differing tax rules in multinational settings. For multinationals, the ETR is especially useful as it reflects the overall tax rate across multiple jurisdictions, rather than the rates applicable in individual countries.

Examples of Effective Tax Rate in Practice

Example 1 – Multinational Corporation in Multiple Tax JurisdictionsTax jurisdiction refers to the authority granted to governments or local taxing bodies to impose taxes on individuals, businesses, or transactions within a specific geographical area or based on particular criteria. This concept is a cornerstone of international tax law, determining which countries have the right to tax certain individuals or entities and under what conditions. As businesses and individuals... More

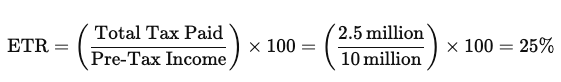

Consider a global company with operations in the United States, Germany, and Ireland. While the statutory corporate taxCorporate Tax refers to the tax imposed by governments on the income or capital of corporations. Corporations, considered separate legal entities, are taxed on their profits, meaning the income generated from their operational activities, investments, and other financial undertakings. This tax is generally a key revenue source for governments, helping to fund public services, infrastructure, and other essential functions. The... More rates in each jurisdiction differ, the company’s ETR accounts for taxes paid in each region and the applicable deductions or credits. If the company’s combined pre-tax income is $10 million, with a total tax payment of $2.5 million, the ETR is calculated as:

This 25% ETR reflects the total taxes paid across jurisdictions, providing a holistic view of the company’s tax efficiency.

Example 2 – Domestic Company Utilising Tax Credits

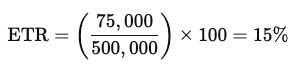

A company operating solely in the UK, with a statutory tax rate of 19%, might qualify for several government incentives, such as research and development (R&D) tax credits, which lower the taxable incomeThe tax base is a fundamental concept in taxation, representing the total amount of economic activity or assets upon which a tax is levied. It is the foundation upon which governments calculate the amount of tax owed, based on factors like income, property value, sales, or corporate profits. Understanding the tax base is essential for tax professionals, businesses, and policymakers,... More. If this company reports £500,000 in pre-tax earnings but pays £75,000 in tax, the ETR would be:

In this case, the ETR is lower than the statutory rate, illustrating how incentives reduce the overall tax burdenTax liability represents the total amount of tax owed by an individual or business to a tax authority, whether local, national, or international. This obligation arises through various forms of income, profits, or transactions subject to taxation laws and regulations. Understanding tax liability is essential for compliance and efficient financial management for corporations and individuals. It influences how businesses structure... More.

Example 3 – Industry-Specific Tax Concessions in Energy Sector

Companies in the renewable energy sector often benefit from tax concessions and subsidies. For instance, a renewable energy company in South Africa with R10 million in pre-tax earnings and R1 million in total tax paid would have an ETR of 10%, which is significantly lower than the standard corporate taxCorporate Tax refers to the tax imposed by governments on the income or capital of corporations. Corporations, considered separate legal entities, are taxed on their profits, meaning the income generated from their operational activities, investments, and other financial undertakings. This tax is generally a key revenue source for governments, helping to fund public services, infrastructure, and other essential functions. The... More rate due to industry-specific deductions.

Key Judgments Involving Effective Tax Rate

- Apple Inc. v. European Commission (EU General Court)

In this high-profile case, the European Commission challenged Apple’s low ETR in Ireland, claiming it resulted from selective tax treatment. Apple’s ETR, influenced by Ireland’s tax rulingsA tax ruling is a formal decision provided by a tax authority, clarifying how specific tax laws and regulations apply to an individual taxpayer or a corporate entity in particular circumstances. Often sought before a significant financial transaction or investment, tax rulings offer legal certainty by outlining the tax implications and obligations in advance. Such rulings are pivotal for multinational... More, was substantially lower than the EU statutory rate. The case underscored how strategic use of tax rulingsA tax ruling is a formal decision provided by a tax authority, clarifying how specific tax laws and regulations apply to an individual taxpayer or a corporate entity in particular circumstances. Often sought before a significant financial transaction or investment, tax rulings offer legal certainty by outlining the tax implications and obligations in advance. Such rulings are pivotal for multinational... More can impact ETR and raised awareness of potential tax avoidanceTax avoidance refers to the practice of legally structuring financial activities to minimise tax liability, reducing the amount of tax owed without violating laws. Unlike tax evasion, which is illegal and involves concealing income or misreporting, tax avoidance operates within the framework of the law. Multinational enterprises (MNEs) and individuals often engage in tax planning strategies that reduce tax liabilities... More strategies among multinationals. - Coca-Cola Co. v. Commissioner of Internal Revenue (US Tax Court)

Coca-Cola’s ETR came under scrutiny due to its transfer pricingTransfer pricing is a fundamental concept in international taxation that defines the pricing methods and rules applied to transactions between related entities within a multinational enterprise (MNE). In the context of tax regulations, it governs how prices for goods, services, or intangibles (such as intellectual property) are set when these items are exchanged between different branches, subsidiaries, or affiliates of... More practices with foreign affiliates. The case highlighted that transfer pricingTransfer pricing is a fundamental concept in international taxation that defines the pricing methods and rules applied to transactions between related entities within a multinational enterprise (MNE). In the context of tax regulations, it governs how prices for goods, services, or intangibles (such as intellectual property) are set when these items are exchanged between different branches, subsidiaries, or affiliates of... More arrangements can significantly impact ETR, especially for multinationals operating across diverse tax jurisdictionsTax jurisdiction refers to the authority granted to governments or local taxing bodies to impose taxes on individuals, businesses, or transactions within a specific geographical area or based on particular criteria. This concept is a cornerstone of international tax law, determining which countries have the right to tax certain individuals or entities and under what conditions. As businesses and individuals... More. The court’s ruling emphasised the importance of aligning ETR with economic substanceEconomic substance is a foundational principle in taxation and business law, ensuring that transactions and corporate structures reflect genuine economic reality beyond their legal form. The concept aims to prevent tax avoidance by evaluating whether a transaction or arrangement has a real business purpose and economic effect other than merely achieving a tax benefit. It ensures that taxpayers cannot exploit... More in intercompany transactionsIntra-Group Transactions are interactions between entities within the same multinational enterprise (MNE). Such transactions form the backbone of related-party dealings and are essential in managing global operations and aligning business objectives across jurisdictions. Understanding intra-group transactions is critical in international tax and transfer pricing, as they directly impact a company's tax obligations, profitability, and compliance standing. Tax professionals, accountants, lawyers,... More. - Amazon v. European Commission

Amazon’s low ETR resulted from intercompany agreementsIntercompany Agreements (ICAs) are legally binding contracts between two or more entities within the same corporate group. These agreements outline the terms and conditions of transactions such as the sale of goods, provision of services, use of intellectual property, or intercompany financing. ICAs are crucial for managing transfer pricing compliance, mitigating tax risk, and demonstrating that intercompany transactions are conducted... More and profit-shifting strategies. The European Commission argued that Amazon’s ETR did not reflect its economic activity in the EU. This case showcased how different tax jurisdictionsTax jurisdiction refers to the authority granted to governments or local taxing bodies to impose taxes on individuals, businesses, or transactions within a specific geographical area or based on particular criteria. This concept is a cornerstone of international tax law, determining which countries have the right to tax certain individuals or entities and under what conditions. As businesses and individuals... More address multinational tax structures and underscored the role of ETR as a tool for detecting aggressive tax planningAggressive tax planning (ATP) refers to strategies employed by individuals or corporations to minimise their tax liabilities, often by exploiting legal loopholes, discrepancies between tax jurisdictions, or complex structures in tax law. While not always illegal, ATP can push the boundaries of acceptable tax behaviour, as it may compromise the intent of the law. ATP is commonly characterised by arrangements... More.