Hyatt International vs. India (ADIT)

Table of Contents

Download the full judgment here

The Hyatt International Southwest Asia Ltd. vs. Additional Director of Income Tax judgment delivered by the High Court of Delhi on September 19, 2024, tackles several pivotal issues regarding the attribution of income to a Permanent Establishment (PE) in India, even in cases where the global entity has incurred financial losses. This judgment is a significant landmark in international taxation and transfer pricing, specifically in the context of the Double Taxation Avoidance Agreement (DTAA) between India and the United Arab Emirates (UAE).

Case Information

- Court: High Court of Delhi

- Case No: ITA 216/2020 and related matters

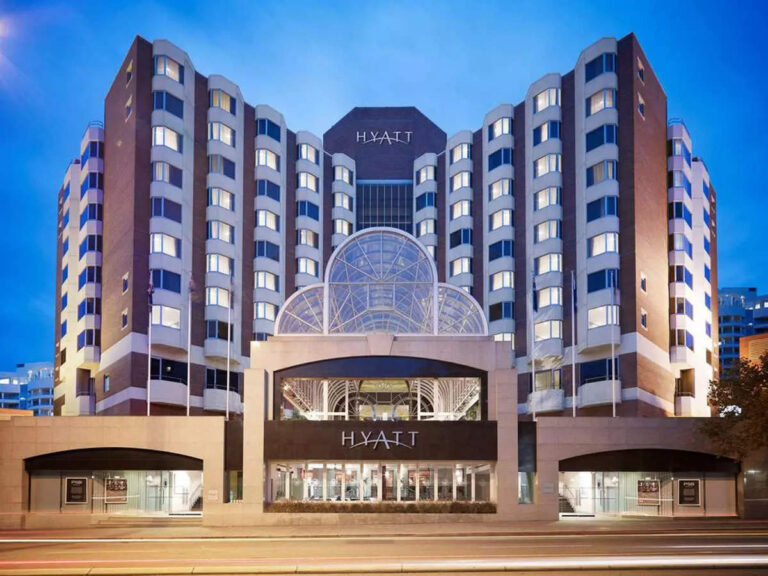

- Applicant: Hyatt International Southwest Asia Ltd.

- Defendant: Additional Director of Income Tax

- Judgment Reserved: July 5, 2024

- Judgment Pronounced: September 19, 2024

Judgment Summary

The court faced the issue of whether profits could be attributed to a Permanent Establishment (PE) in India when the global entity Hyatt International Southwest Asia Ltd. incurred financial losses. The judgment focused primarily on interpreting Article 7 of the Double Taxation Avoidance Agreement (DTAA) between India and the UAE, which governs the taxation of business profits. Hyatt International argued that since the global entity was in a loss-making position, no income should be attributed to the Indian PE. However, the High Court rejected this argument, ruling that the PE must be treated as a distinct entity for taxation purposes, and any profits generated by the PE in India could be taxed, irrespective of global losses.

Key Points of the Judgment

Background

Hyatt International Southwest Asia Ltd., headquartered in the UAE, provides management services to various hotels across different regions, including India. As part of its business operations, the company has a PE in India that manages specific hotel properties within the country. The case arose when the Indian tax authorities sought to attribute profits to this PE for taxation purposes under Article 7 of the India-UAE DTAA.

Hyatt International contested this attribution because the company, on a global level, had incurred losses for the relevant assessment year. The company argued that since it had suffered a loss at the entity level, no income should be attributable to the PE in India. This argument was rooted in a previous judgment in the Nokia Solutions and Networks OY case, where the court had ruled that profit attribution to a PE was not warranted if the global entity had incurred losses.

However, the revenue authorities maintained that the PE in India was a distinct taxable entity and that profits generated locally should be subject to Indian taxation, regardless of the enterprise’s global financial performance.

Core Dispute

The central issue in this case was whether local profits earned by a PE in India could be taxed if the global entity incurred a loss. Specifically, the court was asked to determine if the profits attributable to the Indian PE could be taxed, even though Hyatt International suffered losses at a global level. The argument rested on the interpretation of Article 7 of the DTAA, which governs the taxation of business profits. Article 7(1) states that profits of an enterprise in a contracting state (in this case, the UAE) shall be taxable only in that state unless the enterprise carries on business in the other contracting state (India) through a PE situated therein.

Hyatt International argued that since it had incurred losses globally, no profits could be attributed to the Indian PE, and therefore, no tax should be levied on the PE in India. The company relied on the precedent set in the Nokia Solutions case, where the court had ruled that profits could only be attributed to a PE if the global entity earned profits.

Revenue authorities, on the other hand, argue that the PE in India should be treated as a separate and distinct entity for tax purposes. Therefore, even if the global entity suffered losses, any income attributable to the Indian PE could still be taxed under the provisions of the Income Tax Act and the DTAA.

Court Findings

The Delhi High Court held that the Indian PE of Hyatt International must be treated as a distinct entity for tax purposes. The court rejected Hyatt’s argument that no profits could be attributed to the PE due to global losses. The court emphasized that a PE should be considered an independent entity when determining tax liability. Thus, even if the global entity suffered losses, profits generated by the PE in India could still be taxed.

The court distinguished this case from the Nokia Solutions and Networks OY case, explaining that the latter ruling was based on specific factual circumstances that did not apply to the present case. In Nokia, the court ruled that no profit attribution was warranted since the global entity had incurred losses and no income was attributable to the PE. However, in the Hyatt case, the court noted that the PE had generated profits in India, which could be taxed, even if the global entity had reported losses.

The court also examined the DTAA between India and the UAE, specifically Article 7, which deals with attributing profits to a PE. The court held that Article 7 did not preclude attributing profits to a PE in cases where the global entity suffered losses. Instead, the court ruled that the profits attributable to the PE should be determined independently of the enterprise’s international financial performance.

Outcome

The court ruled in favour of the revenue authorities, holding that the profits attributable to Hyatt International’s Indian PE could be taxed, even though the global entity incurred losses. The court reaffirmed that a PE should be treated as an independent entity for tax purposes, and any profits generated locally could be taxed, irrespective of the enterprise’s global financial performance.

This ruling has significant implications for multinationals operating in India through PEs. It clarifies that local profits can be taxed independently of global financial results, and enterprises cannot use global losses as a shield to avoid taxation of local profits.

Major Issues and Areas of Contention

Several key issues were at the heart of the case:

- Global Losses vs. Local Profits: The primary issue was whether global financial losses could negate the attribution of profits to a PE in India. Hyatt International argued that since the enterprise had incurred losses globally, no income should be attributed to the PE. However, the court rejected this argument, ruling that the PE should be treated separately for tax purposes.

- Interpretation of Article 7 of the DTAA: Another major issue was the interpretation of Article 7 of the DTAA between India and the UAE. Hyatt International argued that Article 7 precluded the attribution of profits to a PE in cases where the global entity incurred losses. The court, however, held that Article 7 did not prevent the taxation of profits attributable to a PE, even in cases where the global entity suffered losses.

- Treatment of the PE as an Independent Entity: The court’s ruling emphasized the importance of treating a PE as a distinct and independent entity for tax purposes. This principle was central to the court’s decision, as it allowed the taxation of profits generated by the PE in India, regardless of the enterprise’s global financial performance.

Was this Decision Expected or Controversial?

This decision was somewhat controversial, as it deviated from the precedent set in the Nokia Solutions and Networks OY case, where the court had ruled that no profits could be attributed to a PE if the global entity incurred losses. The Hyatt International ruling, however, clarified that the attribution of profits to a PE should be determined independently of the global financial performance of the enterprise. This decision sets a significant precedent and may have far-reaching implications for multinationals operating in India.

From a legal perspective, the decision was expected, as it aligns with the general principles of international taxation and the treatment of PEs under the DTAA. However, it may be viewed as controversial by multinationals, as it opens the door for tax authorities to attribute profits to a PE even in cases where the global entity is in a loss-making position.

Significance for Multinationals

The ruling has several important implications for multinational enterprises (MNEs):

- Independent Taxation of Local Profits: The court’s ruling reinforces the principle that PEs should be treated as independent entities for tax purposes. MNEs can no longer rely on global losses to shield local profits from taxation. This means that MNEs must carefully manage their PEs and ensure that their local operations are compliant with local tax laws.

- Increased Scrutiny of PEs: The ruling may lead to increased scrutiny of PEs by tax authorities, particularly in cases where the global entity is in a loss-making position. MNEs should be prepared to provide detailed documentation of the activities and profits generated by their PEs to avoid disputes with tax authorities.

- Potential Tax Liabilities: The decision highlights the potential tax liabilities that MNEs may face if they operate through PEs in India. Even if the global entity incurs losses, the profits generated by the PE in India can still be taxed, potentially leading to significant tax liabilities for the enterprise.

Significance for Revenue Services

For revenue services, the ruling provides a legal basis for attributing profits to a PE even in cases where the global entity incurs losses. This decision is a significant win for tax authorities, as it allows them to tax the local profits of PEs, regardless of the financial performance of the global entity.

The ruling also reinforces the importance of treating PEs as independent entities for tax purposes. This principle will likely be applied in future cases involving the taxation of PEs, providing revenue authorities with greater flexibility in attributing profits to PEs and expanding the tax base.

Additional Relevant Cases

- Commissioner of Income Tax (International Taxation) vs. Nokia Solutions and Networks OY (2022): This case dealt with similar issues regarding the attribution of profits to a PE. However, the Hyatt International case court distinguished the facts and circumstances, ruling that the PE’s gains could be taxed despite global losses.

- Motorola Inc. vs. Deputy Commissioner of Income Tax (2005): This Special Bench ruling established principles for attributing profits to PEs and is often cited in cases involving the taxation of PEs.

- DIT (International Taxation), Mumbai vs. Morgan Stanley & Co. Inc. (2007): This case reinforced the arm’s length principle in the context of profit attribution to a PE, emphasizing the importance of treating the PE as a separate and independent entity.